Dental Financing Helps You Afford the Care You Want and Need

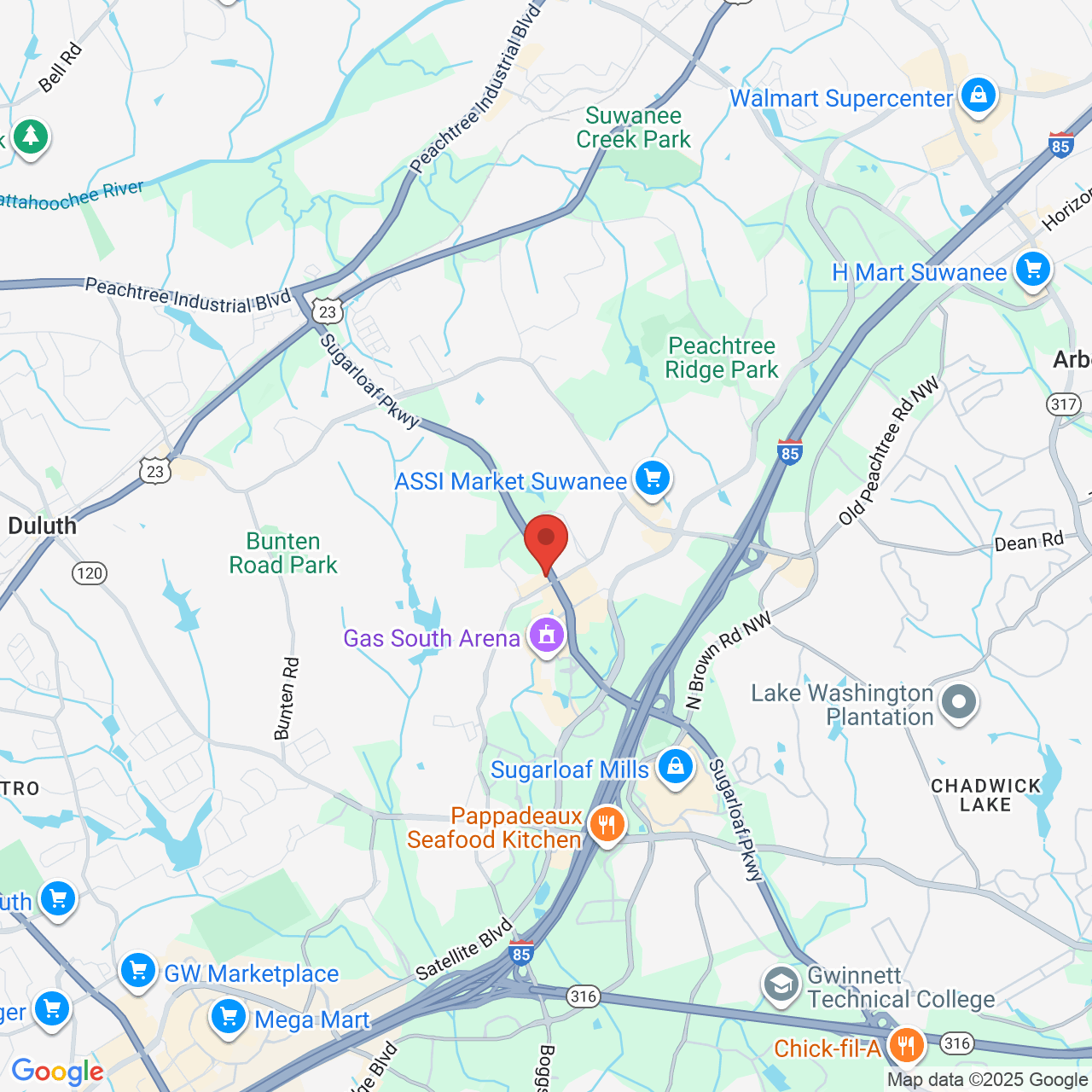

We offer dental financing at our Duluth, GA, practice to help place care within your budget.

Insurance companies have a certain limit for dental expenses per year – usually $1,000 or $1,500. This limit has not changed since dental insurance was introduced in the 1960s. The insurance company pays a percentage of the expense depending on the type of service provided – either preventive, basic or major. However, when an insurance company says that they cover 100 percent of a certain service; they mean 100 percent of the fee they set. This is based on the insurance plan, and not necessarily our office fees. This fee will also vary from plan to plan from the same insurance company! This may leave the patient with a balance toward his or her treatment, in spite of the insurance company claiming to cover 100 percent of that type of treatment.

For example, a typical fee in our area for an adult cleaning is $82. Most insurance companies will pay 100 percent of this fee; however, we have some patients with plans that pay as little as $40, although the insurance company refers to the $40 payment as “100 percent of usual, customary, and reasonable”.

We will always do our best to estimate how much your insurance plan will pay towards each visit and will give you a written treatment plan to minimize unexpected costs.

We are occasionally asked why we don’t participate in a particular insurance plan, or if we would consider participating in a certain plan. There are many insurance plans that restrict your choice of doctors to those on a specific list of participating offices. The participation agreement between those plans and the providers requires the provider to deliver care at a discount to those patients covered by that plan. For some plans the discount is small, for some it is not.

We believe that dentistry is a service, not a product. For us, the manner in which that service is provided and the attention to detail makes all the difference. We do not participate in plans that require us to heavily discount our treatment prices and encourage us to make up the difference in volume. We cannot be a “volume” practice and still provide the level of care and service that built our reputation. Our reputation has been built by using high-quality materials and technology and by providing exemplary customer service. We cannot be a “volume” practice and provide that level of care and attention to our patients.

Our office will be more than happy to file your claims and provide the best estimate for your out-of-pocket expense.

We are currently an in-network provider for:

- Aetna PPO

- Ameritas

- Assurant

- BCBS 300 Plan

- Cigna Radius

- Delta Dental Premiere

- Dentemax

- Guardian

- Humana

- Metlife

- Principal

- United Healthcare

We accept all other PPO plans as an out-of-network provider

IN OFFICE FINANCING

Never let finances get in the way of your dental health!

Our office accepts cash, checks, and credit cards (Visa, Master Card, Discover and American Express) for payment.

The fee for each visit will be discussed prior to your treatment. Any amount not covered by your insurance is your responsibility. We have multiple in-office financing options available for treatment in excess of $500.

We believe that money should not stand in the way of your having a healthy mouth. If you need extensive dental care and are concerned about cost, we are happy to offer financing through Care Credit®. We participate in their program that provides 6 months or up to 12 months for large cases interest free as well as extended interest bearing plans.

Please ask for more information or visit www.carecredit.com

UTILIZING YOUR HEALTH SAVINGS ACCOUNT (HSA) AND FLEX SPENDING ACCOUNT (FSA)

Many companies offer their employees a Flexible Spending Account (FSA) and/or Health Savings Account (HSA) to assist with medical/dental co-payments. Let us know if you have one of these accounts so we can help you maximize your health benefits.

Flexible Spending Account (FSA)

A flexible spending account (FSA), also known as a flexible spending arrangement, is one of a number of tax-advantaged financial accounts that can be set up through a cafeteria plan of an employer in the United States. An FSA allows an employee to set aside a portion of earnings to pay for qualified expenses as established in the cafeteria plan. It is most commonly for medical expenses but often for dependent care or other expenses such as dental. Money deducted from an employee’s pay into an FSA is not subject to payroll taxes, resulting in substantial payroll tax savings. One significant disadvantage to using an FSA is that funds not used by the end of the plan year are lost to the employee.

The most common type of flexible spending account, the medical expense FSA (also medical FSA or health FSA), is similar to a health savings account (HSA) or a health reimbursement account (HRA). In addition, funds in a health savings account are not lost when the plan year is over, unlike funds in an FSA. Paper forms or an FSA debit card, also known as a Flexcard, may be used to access the account funds.

Most cafeteria plans offer two different flexible spending accounts; one is for qualified medical expenses and the other is for dependent care expenses. A few cafeteria plans offer other types of FSAs, especially if the employer also offers an HSA. Participation in one type of FSA does not affect participation in another type of FSA, but funds cannot be transferred from one FSA to another.

Health Savings Account (HSA)

A health savings account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a High Deductible Health Plan (HDHP). The funds contributed to an account are not subject to federal income tax at the time of deposit. Unlike a flexible spending account (FSA), funds roll over and accumulate year to year if not spent.

HSAs are owned by the individual, which differentiates them from company-owned Health Reimbursement Arrangements (HRA) that are an alternate tax-deductible source of funds paired with either HDHPs or standard health plans. HSA funds may currently be used to pay for qualified medical and dental expenses at any time without federal tax liability or penalty. However, beginning in early 2011 OTC (over-the-counter) medications could not be paid with HSA dollars without a doctor’s prescription.

Withdrawals for non-medical expenses are treated very similarly to those in an Individual Retirement Account (IRA) in that they may provide tax advantages if taken after retirement age, and they incur penalties if taken earlier.